Ensuring the health and well-being of your beloved Labradoodle by investing in pet health insurance is not just a wise decision; it’s a compassionate and responsible choice that truly reflects your commitment to providing the best care possible for your furry companion. By opting for pet insurance, you are safeguarding your Labradoodle’s health and bringing peace of mind, knowing they will receive top-notch medical care without the burden of financial strain in times of need.

Pet health insurance is increasingly important for Labradoodle owners. Labradoodles are beloved family pets known for their friendly and energetic nature. However, like any other breed, Labradoodles can experience health issues that may require veterinary attention.

The rising cost of veterinary care makes pet health insurance essential for covering unexpected medical expenses.

By getting health insurance for your Labradoodle, you can ensure you are prepared for unforeseen circumstances, from routine check-ups to vaccinations and more serious conditions or accidents; having coverage can alleviate the financial burden of veterinary expenses.

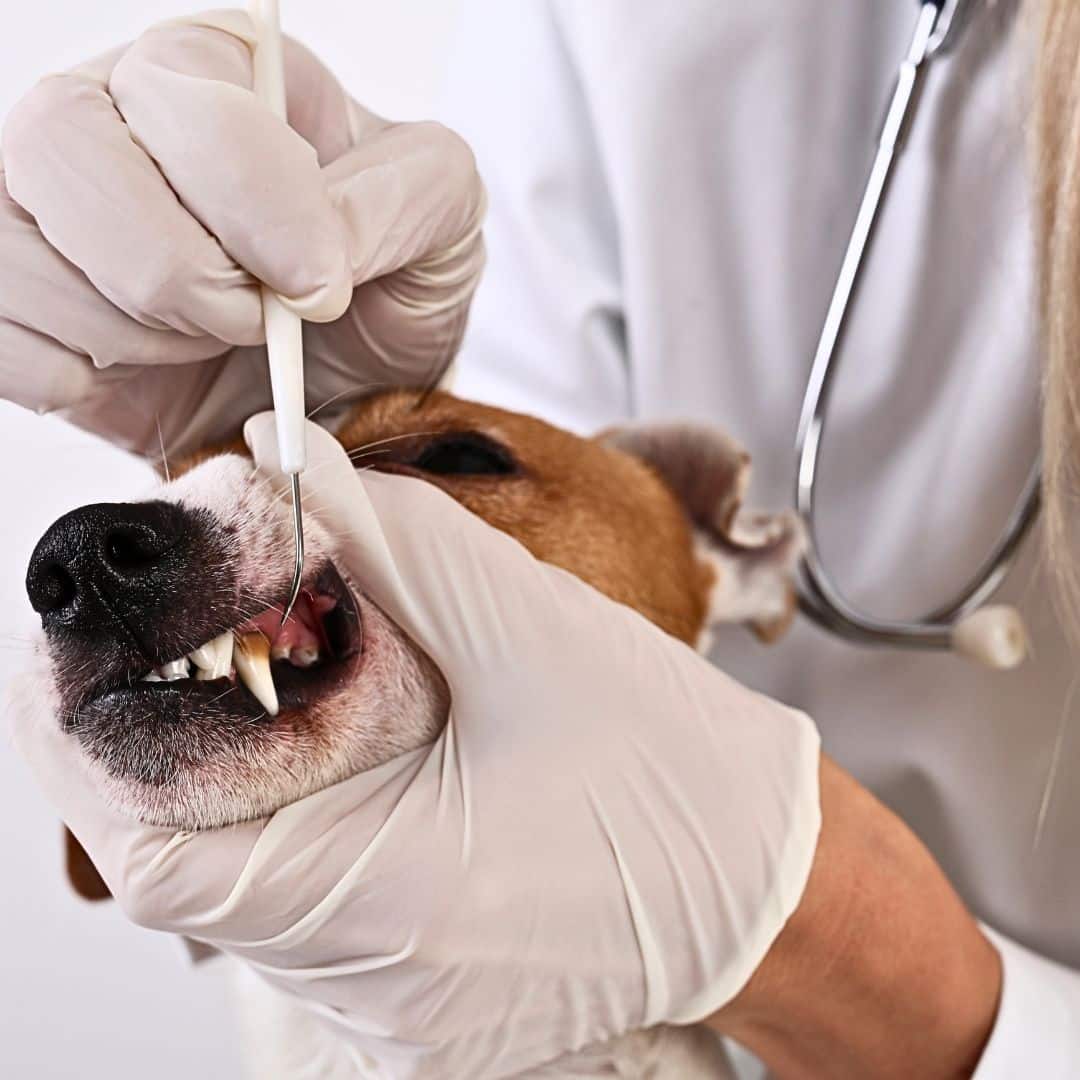

Additionally, pet health insurance often covers preventive care, such as annual exams and dental cleanings.

This proactive approach to your Labradoodle’s healthcare detects issues early on. It prevents your Labradoodle from developing a more serious problem.

Having pet health insurance also provides peace of mind. Rest easy knowing that if your Labradoodle requires medical attention or emergency treatment, you won’t have to make important decisions based on financial constraints.

The Top Reasons to Get Pet Health Insurance for Your Labradoodle

- Financial Protection: Avoiding unexpected veterinary expenses and managing healthcare costs.

- Comprehensive Coverage: Ensuring your Labradoodle receives necessary medical treatments and preventive care.

- Peace of Mind: Knowing your beloved pet’s health is safe.

- Easier Access to Veterinary Services: Expanding your options for choosing quality veterinary care.

Frequently Asked Questions about Pet Health Insurance for Labradoodles

“What does pet health insurance typically cover?”

Pet health insurance typically covers a range of expenses related to the well-being of your furry friend. Here are some common coverage areas:

1. Accidents

Pet health insurance covers the costs associated with unexpected accidents, such as injuries from falls, car accidents, or accidental ingestion of harmful substances.

2. Illnesses

Insurance plans often cover veterinary costs for illnesses like infections, allergies, digestive issues, and common diseases.

3. Surgeries

If your pet requires surgery, insurance can help ease the financial burden by covering the expenses associated with procedures such as tumour removals, orthopedic surgeries, or emergency surgeries.

4. Medications

Many insurance plans cover prescription medications prescribed by veterinarians to manage your pet’s health conditions or aid recovery from an illness or surgery.

5. Preventive care

Some pet health insurance plans cover routine preventive care, including vaccinations, annual check-ups, flea and tick prevention, heartworm medication, and dental cleanings. This coverage aims to keep your pet healthy and prevent future health problems.

It’s important to note that each pet insurance provider offers different coverage options, and plans may have certain limitations or exclusions. Before deciding, it’s always advisable to review the policy details and consult the insurance provider to understand what specific items are covered.

Pet Health Insurance can provide peace of mind, knowing that you are financially protected in case of unexpected medical expenses for your beloved companion. AKC says: Many Insurance Companies offer a variety of plans with different coverages, from emergency visits to regular (or wellness) veterinary care, like vaccinations. Managing the finances of a pet’s sometimes-lifesaving-care makes a difficult situation that much harder.

“Are there any breed-specific considerations when it comes to pet health insurance?”

Regarding pet health insurance, there are generally no specific considerations or exclusions based on particular breeds, such as Labradoodles or similar mixes. Most pet insurance providers cover various species, including mixed breeds, without discriminating against any specific breed.

However, it’s important to note that pet insurance policies may not cover certain pre-existing conditions. These are typically health issues that your pet had before the approach was taken out. Additionally, some hereditary diseases may have limited coverage or exclusions. It’s always advisable to carefully review the terms and conditions of any pet insurance policy to understand what is covered and what is not.

Genetics

Suppose you have a Labradoodle or a similar breed. In that case, it’s recommended to consider the potential health issues that could be more common in these breeds. For instance, Labradoodles may be prone to genetic conditions such as hip dysplasia or allergies.

While pet insurance providers may not specifically exclude these conditions, coverage for their treatment may vary depending on the policy. Researching and comparing policies offered by different pet insurance providers is important. Look for comprehensive coverage that includes hereditary conditions and sufficient protection for potential health issues affecting your specific breed.

Remember that each pet insurance provider has its terms and conditions, so it’s important to read the policy thoroughly and ask any questions you may have before making a decision. Doing so lets you find a suitable pet insurance plan that meets your Labradoodle’s healthcare needs and offers you peace of mind.

“How do I find the right pet health insurance plan for my Labradoodle?”

Finding the right pet health insurance plan for your Labradoodle can seem overwhelming. Still, with a few helpful tips, you can navigate through the options and choose the one that suits your furry friend’s needs and your budget.

Here are some steps to guide you in the process:

Research different providers.

Start by researching various pet insurance providers. Look for reputable insurance companies with positive reviews and a comprehensive coverage history.

Determine your Labradoodle’s needs.

Consider your Labradoodle’s age, breed, and any pre-existing conditions. Some insurance plans may offer specific coverage tailored to certain species or age groups.

Compare coverage options

Look at the different coverage options offered by each provider. Assess what is included in their plans, such as accidents, illnesses, hereditary conditions, medications, surgeries, and routine care. Determine which coverage elements are most important for your Labradoodle.

Examine limits and deductibles.

It is important to be aware of any annual or lifetime coverage limits, and deductibles can affect your expenses in case of a claim.

Consider waiting periods

Be aware that many pet insurance policies have waiting periods before coverage begins. Understand these waiting periods and ensure they align with your Labradoodle’s health status.

Check reimbursement rates

Look into the reimbursement rates offered by different plans. Some policies reimburse based on veterinary costs, while others have set benefit schedules. Consider which option would work best for you financially.

Customers Reviews

Take time to read customer reviews and testimonials about each provider you consider. This can give you insights into their customer service, claim process, and overall satisfaction levels.

Request quotes

Once you have narrowed your choices, request quotes from the remaining providers. Compare the cost of premiums against the coverage offered to find the best value for your money.

Consult Your Veterinarian

Please get advice from your veterinarian. They may have recommendations based on their experience with different insurance providers and plans.

Make an informed decision.

After considering all the above factors, decide based on what suits your Labradoodle’s needs and your budget best.

Remember, investing in pet health insurance can provide peace of mind, knowing that your Labradoodle’s medical expenses will be covered in case of unexpected illnesses or accidents. Take the time to compare plans and choose wisely to ensure the best possible care for your

“Is pet health insurance worth the investment?”

Investing in pet health insurance is worth considering. While it may seem like an additional expense, the cost-benefit analysis of having pet insurance indicates that the potential savings and peace of mind it offers make it a valuable investment.

First and foremost, pet health insurance provides financial protection against unexpected veterinary bills.

Like humans, pets can also face accidents or develop illnesses requiring medical attention. Veterinary costs can add up, especially in emergency surgeries or long-term treatments. Pet insurance gives peace of mind, knowing you’re financially prepared to handle these unforeseen circumstances without compromising your pet’s well-being.

Furthermore, pet insurance allows you to provide the best care for your Labradoodle without worrying about the cost.

It enables you to opt for comprehensive treatments and procedures that might otherwise be financially out of reach. This means you won’t have to make difficult decisions based solely on your budget but on what is best for your pet’s health.

Additionally, pet insurance often covers routine preventive care such as vaccinations, annual check-ups, and dental cleanings.

Covering these expenses ensures your pet receives the necessary preventive measures to maintain their health and well-being.

Moreover, many pet insurance policies cover hereditary conditions and chronic illnesses.

These conditions require long-term treatment or specialized care, which can be expensive. Insurance can alleviate the financial burden of managing these conditions, allowing you to focus on providing your beloved companion with the best quality of life.

Lastly, having pet health insurance provides peace of mind.

Knowing you have a safety net ensures you can promptly seek medical attention for your pet without hesitation or delay.

While pet health insurance requires investment, its potential savings in unexpected veterinary bills and the peace of mind it provides make it worthwhile. By opting for pet insurance, you can ensure your Labradoodle receives the best care without compromising your financial stability.

“What should I consider when filing a claim with my pet health insurance provider?”

Several important factors must be considered when filing a claim with your pet’s health insurance provider. Here is a list of things to keep in mind to ensure a smooth and successful claims process:

Familiarize yourself with your policy.

Review and understand your pet’s health insurance policy thoroughly, and pay attention to the coverage limits, deductible amounts, and any specific requirements or exclusions related to claims.

Keep all relevant documentation.

To support your claim, gather all necessary documentation, such as invoices, receipts, medical records, and itemized treatment plans. Make sure you have copies of all documents before submitting them.

Understand the claims process.

Contact your insurance company or review their website to learn about their specific claims process. Understand the timelines for submitting claims, any required forms, and the preferred method of communication (online portal, email, or mail).

Provide accurate information

When filling out claim forms or providing information over the phone, provide accurate details about your pet’s condition, treatment received, and any pre-existing conditions. Providing incorrect or incomplete information could lead to delays or claim denials.

Submit claims promptly

File your claim as soon as possible after receiving treatment for your pet. Delaying the claim submission may result in complications or missed deadlines.

Follow instructions carefully

Pay close attention to any instructions your insurance provider provides regarding claim submission. This includes completing forms accurately, attaching all required documents, and adhering to any specific guidelines outlined by the insurer.

Keep copies of everything.

Make copies of all documents you submit to your insurance provider for your records. It will help you track the progress of your claim and serve as a reference point if any issues arise.

Communicate with your veterinarian regarding the documents needed.

Inform your veterinarian that you will file a claim with your pet’s health insurance provider. They can assist you by providing necessary documents or answering questions related to the treatment provided.

Be patient

Claim processing can take time, so it’s important to be patient. If you are still waiting to receive an update on your claim within a reasonable timeframe, contact the insurance provider for an update.

By considering these factors and following the necessary steps, you increase the likelihood of a successful claim submission with your pet’s health insurance provider. Remember, each insurance provider may have different requirements, so it’s essential to familiarize yourself with your specific policy and contact your provider directly if you have

7 Top Insurance Companies in Canada and What They Offer Addressing Common Concerns about Pet Health Insurance

The options can be overwhelming, so choosing the right insurance company in Canada is important. However, I’m here to assist you by providing information on Canada’s 10 top insurance companies and what they offer. I’ll also address common concerns about pet health insurance, including Petsecure.

1. Petsecure: As one of the leading pet health insurance providers in Canada, Petsecure offers various plans to suit different needs, including coverage for accidents, illnesses, and wellness care.

2. Intact Insurance: Offers a wide range of insurance products, including pet insurance coverage for accidents and illnesses.

3. Desjardins Insurance: Provides comprehensive pet insurance plans that cover veterinary fees, medication, and surgeries.

4. T.D. Insurance: Offers pet insurance plans that cover accidents, illnesses, and even alternative therapies.

5. Aviva Canada: Provides pet insurance coverage for accidents and illnesses and additional options such as dental care.

6. The Co-operators: Offers customizable pet insurance coverage for accidents, illnesses, and preventive care.

7. Economical Insurance: Pet insurance plans for accidents, illnesses, and routine care are offered.

Conclusion: Secure Your Labradoodle’s Health and Well-being with Pet Insurance

In conclusion, securing your Labradoodle’s health and well-being with pet insurance is a decision that can provide you with peace of mind and ensure a bright future for your furry companion. By investing in pet insurance, you proactively protect your Labradoodle from unexpected medical expenses and ensure they receive the best care.

Pet insurance lets you make informed decisions about your Labradoodle’s healthcare coverage. You can choose a policy that suits their needs, whether comprehensive coverage or focusing on particular areas such as accidents or illnesses. This empowers you to take control of their health and make decisions based on what is best for them.

With pet insurance, you no longer have to worry about the financial burden of expensive veterinary bills. Instead, you can focus on providing the love and attention your Labradoodle deserves without hesitation or stress.

Pet Insurance investment is an investment in your Labradoodle’s future and peace of mind. It ensures they have access to the necessary medical care, allowing them to live a happy and healthy life by your side.

So ensure your Labradoodle’s health and well-being today with pet insurance. Take control of their future by making informed decisions about their healthcare coverage. With pet insurance, you can enjoy precious moments with your beloved Labradoodle, knowing that they are protected every step of the way.